January 2019 Employment Law Update

Employment Law Timetable for 2019

1st January 2019 - executive pay gap reporting in force

From 1st January 2019, reporting regulations (2018) made under the Companies Act 2006 require UK listed companies with more

than 250 UK employees to report annually on the pay gap between their chief executive and their average UK worker.

The first reports are due in 2020.

29th March 2019 - Brexit

30th March 2019 - gender pay gap reports (public sector)

‘Specified public authorities’, including government departments, the armed forces, local authorities, the NHS and state

schools, with 250 or more employees, are required to publish their gender pay gap reports by this date, based on data

gathered on 31 March each year.

The requirements for the reports, under the Equality Act 2010 (Specific Duties and Public Authorities) Regulations 2017,

are largely the same as those that apply to private and voluntary sector organisations of the same size.

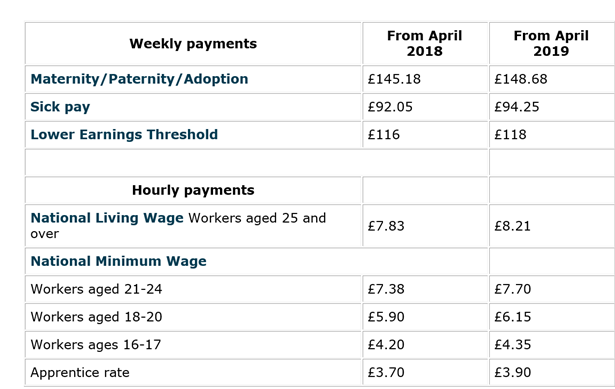

1st April 2019 - National Living Wage and National Minimum Wage changes

Statutory payments: Current rates and increases from April 2019:

More information is available on the GOVUK website.

4th April 2019 - gender pay gap reports (private and voluntary sectors)

Private and voluntary sector employers in England, Wales and Scotland with at least 250 employees are required to publish

information about the differences in pay and bonuses between men and women in their workforce, based on a ‘snapshot’ date

of 5 April each year, under the Equality Act 2010 (Gender Pay Gap Information) Regulations 2017. The first set of reports

was published in 2018, and the second reports are due by 4 April 2019.

Provisions under the Northern Irish Employment Act 2016 mirror these, except they include fines of up to £5,000 for non-compliance, and a requirement to report on ethnicity and disability pay gaps, as well as gender.

6th April 2019 - Good Work Plan: employer penalties for breaches

The government’s ‘Good work plan’, published in December 2018, made a commitment to increase the penalties for employers that repeatedly breach their employment law obligations. Tribunals have the power to impose a £5,000 ‘aggravated breach’ penalty on employers losing cases, and from 6 April 2019, the maximum limit on these penalties will rise to £20,000.

The change is contained in Part 1 of the Employment Rights (Miscellaneous Amendments) Regulations 2019.

6th April 2019 - pay slip changes

Two important changes to the Employment Rights Act 1996, affecting pay slip information, will come into force on 6 April:

- Employers must include the total number of hours worked where the pay varies according the hours worked, for example under variable hours or zero hours contracts.

- Payslips must be given to ‘workers’ and not just employees.

April 2019 - tax on termination payments

The government’s plans to make any part of a termination payment over the sum of £30,000 subject to employer NICs is due to become law on this date. This change was delayed from April 2018.

Watch this Space.....

1st January 2019 - Government consultation on the tribunal system closes

In September 2018 the Law Commission launched a consultation on Employment Law Hearing Structures to consider how employment

law cases are handled and whether the current system could be improved. The consultation will look at a number of questions

including:

- Whether the time limit for employment law claims should be increased to six months in most cases (currently 3 months less one day for most cases); and

- Whether the £25,000 limit for breach of contract claims should be removed and

tribunals allowed to hear such claims whilst an employee is still employed.

The consultation closes on 11 January 2019 after which it is expected the Law Commission will review the responses and publish final recommendations later in 2019.

Good work Plan

The government has published details of the changes it proposes to make to employment law following the Matthew Taylor Good Work review, together with draft legislation. Key proposals include:

- legislation to improve the clarity of the employment status tests and align the employment and tax status frameworks

- a right to a written statement of terms and conditions for workers (as well as employees), from day one (rather than within

two months)

- an increase in the reference period, from 12 weeks to 52 weeks, for calculating an average week's pay for holiday pay purposes

where the worker has variable pay

- a right for workers to request a more fixed working pattern after 26 weeks of service

- a change in legislation relating to continuity of employment, so that a gap of up to four weeks between contracts will not

break continuity of employment (an increase from one week currently)

- a repeal of the Swedish derogation – which currently allows agency workers to be paid less than other permanent employees

in certain circumstances.

- Many of the changes are intended to come into force on 6 April 2020.

Immigration

Following the recent publication of the final report on EEA migration in the UK by the Migration Advisory Committee (MAC), the government has announced more details of its skills-based immigration plans after Brexit and promised to publish a White Paper setting out the details in the autumn.

In the interim period, the EU settlement scheme is intended to apply to EU citizens resident in the UK before 31 December 2020 (and their family members), provided they apply for settled status before 20 June 2021.

Employers will need to evaluate the impact of new travel and work restrictions on their workforce after Brexit and ensure that any necessary applications for settled status are made within the deadline.

Employment Tribunal Case Law Updates

Disability Discrimination

(Williams v Trustees of Swansea University Pension and Assurance Scheme)

The Supreme Court has held that an ill-health early retirement pension awarded to a disabled employee, based on the part-time salary that he was earning before he retired, was not unfavourable treatment for the purposes of a disability discrimination claim

The Supreme Court agreed with the Court of Appeal and held there was nothing intrinsically unfavourable or disadvantageous about the award of a pension, to which the employee was only entitled because of his disability. Although the employer had reduced the employee’s hours from full-time to part-time as a reasonable adjustment because of his disability, had the employee not been disabled and been able to work full time he would not have been entitled to a pension at all at that time.

(Wood v Durham County Council)

The EAT has held that it was not disability discrimination to dismiss an employee with Post Traumatic Stress Disorder (PTSD) and associated amnesia for shoplifting. This was because the employee was dismissed because he had a tendency to steal and, as this is an excluded condition, he did not have a disability for the purposes of the Equality Act.

This decision serves as a useful reminder that not every condition will amount to a disability and there are a number of excluded conditions, including: addiction to nicotine, alcohol or any other substance, a tendency to set fires or to steal, a tendency to physical abuse of other people, exhibitionism and voyeurism, tattoos and body piercings and hay fever.

However, an impairment caused by an excluded condition could be a disability that is protected, so when considering a dismissal in such circumstances it is important to consider the position carefully.

Permanent Health Insurance

(Awan v ICTS UK Ltd)

The Employment Appeal Tribunal (EAT) has held that an employer was in breach of an implied term when it dismissed an employee for incapacity whilst he was contractually entitled to long-term disability benefits.

The EAT held that a term could be implied into the employment contract that, once the employee has become entitled to payment of long-term disability benefits, the employer will not dismiss him on the grounds of his continuing incapacity to work.

This confirms previous case law and whilst employers should continue to include a contractual right to terminate the contract notwithstanding an entitlement to PHI, in view of the potential questions about the enforceability of such a clause, legal advice should be sought before dismissing an employee who is entitled to long-term disability benefits or PHI.

Company liable for data breach

(WM Morrison Supermarkets plc v Various Claimants)

The Court of Appeal has upheld the decision of the High Court that Morrisons was vicariously liable for the actions of a disgruntled employee who posted the payroll details of around 100,000 employees online.

The Court held that there was a sufficient connection between the employee’s actions and his employment to make Morrisons vicariously liable. He had received the data in the course of his employment as a senior IT internal auditor and had been asked to send it to the company’s external auditor. The fact that he had copied it and disclosed it in an unauthorised way was closely connected to what he had been asked to do and his motive was irrelevant.

Morrisons have been granted permission to appeal to the Supreme Court.

Company liable for assault

(Bellman v Northampton Recruitment Limited)

In another vicarious liability case, the Court of Appeal has overturned the High Court’s decision and held that the employer was vicariously liable for its Managing Director’s assault of an employee at a drinking session after a Christmas party.

The Court of Appeal undertook a broad analysis of the Managing Director’s functions and activities and took into account that he was in a dominant position and had a supervisory role. Although the drinking session at which the incident occurred was separate to the Christmas party, the company paid for taxis and drinks and the argument arose when the Managing Director was addressing the employees on his authority. The Court held there was sufficient connection between his job and the assault for his actions to be considered "in the course of employment" to render the employer vicariously liable.

Holiday pay and voluntary overtime

Following its earlier decision in Dudley Metropolitan Borough Council v Willetts, the EAT has confirmed that voluntary overtime can qualify as “normal remuneration” for the purposes of calculating holiday pay under the Working Time Directive, if it is paid over a sufficient period of time on a regular basis.